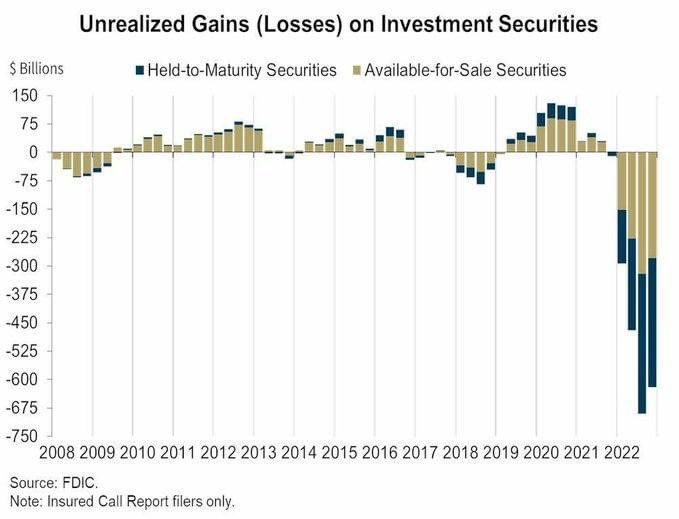

Look at this chart! It says everything one needs to know in a single graphic.

The problem is orders of magnitude worse than it was before the 2008 financial crisis. Many many many times worse!

No, our banking system is not “sound” as your fearless leaders would like you to believe. And the problem this time isn’t caused by “greedy bankers” making and re-packaging unsafe investments (eg no more subprime loans, CDOs, synthetic CDOs, shadow banking etc).

This time the problem is “safe” government treasuries and plain vanilla ol “safe” 30y mortgages.

The problem is these instruments are now worth 60 cents on the dollar. And banks can’t support their banking functions by selling these assets into the market if (when) they need to sell them to support depositor withdrawals and required/mandated liquidity ratios.

And bank withdrawals are comings. It’s unavoidable.

When you can get 5-6% interest on a short term bond or in a money market account, you’re not going to keep your money in a bank offering 0.25%-2%. And banks won’t be able to increase their rates of interest because the long term assets on their books are locked in for maturities 10-30 years.

In short – what’s good for the borrower is horrible for the lender.

It was short-sighted not to predict interest rates would rise when the banks purchased these assets and made these loans; “greed” you might say had something to do with it (it always does); but the real cause of the problem was simply a lack of options for the banks.

One might argue they were doing the only responsible thing in an irresponsible environment. The FED ensured this eventual collapse by manipulating the marketplace. It forced rates down to levels that “goosed” the economy and forced a 10-year sugar high. But the size of that high can only be met with the magnitude of the crash!

The FED created this problem with 10+ years of unsustainable and reckless low interest rates. It manipulated a free market, and now there is far far too much bad paper on the books. This is a systemic issue. It’s not contained to the regional banks

The entire banking system is facing an inescapable collapse.