By Sean Dempsey, 04/15/25

The silver mining sector stands at the threshold of a potentially historic rally, driven by a rare confluence of macroeconomic imbalances, collapsing input costs, and structural mispricing. As of April 2025, the silver-to-gold ratio sits just under 100:1, a level that, while not unprecedented, remains among the most extreme in modern financial history. Meanwhile, oil prices have plummeted in recent weeks, dramatically reducing production costs for miners and expanding margins across the sector. These conditions set the stage for a powerful revaluation of silver, and an even more leveraged upside for silver mining equities. Let me lay out my case as follows:

I. The Silver/Gold Ratio: Historically Elevated at 99.75:1

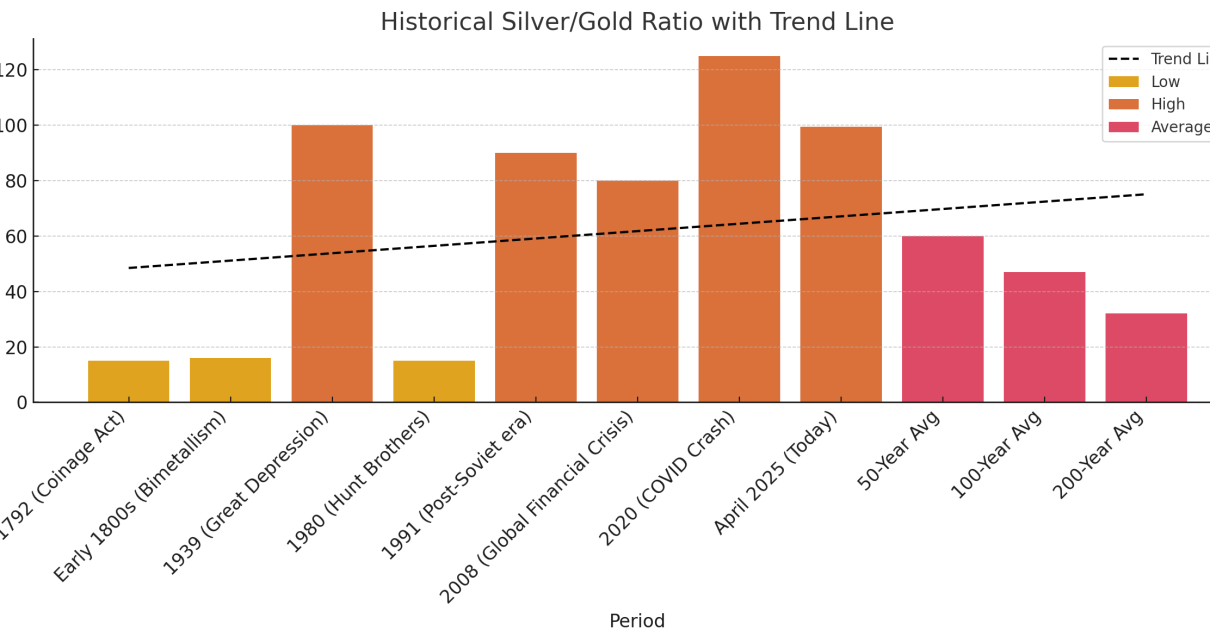

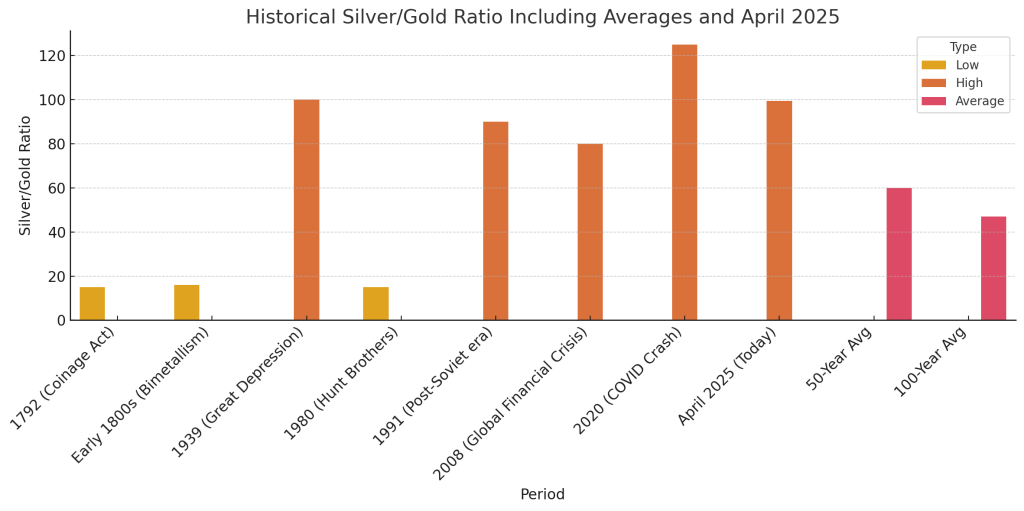

At a current spot price of $3,242.78 for gold and $32.51 for silver, the silver/gold ratio stands at 99.75:1. This level is:

- 66% higher than the 50-year average (~60:1)

- 112% above the 100-year average (~47:1)

- Over 200% higher than the 200-year average (~32:1)

While this ratio is not an all-time high, it is close. It has only been surpassed during two extreme historical anomalies:

- The Great Depression (1930s): The ratio exceeded 98:1 at the peak of deflationary pressure.

- The COVID-19 Crash (March–April 2020): The ratio briefly spiked to an all-time high near 125:1, amid unprecedented economic and monetary turmoil.

Today’s near-100:1 ratio places silver in deeply undervalued territory, indicating a high likelihood of mean reversion in the coming cycle, which is often accompanied by dramatic outperformance in silver relative to gold.

II. Falling Oil Prices Will Supercharge Mining Margins

Silver mining is energy-intensive, and energy represents one of the most significant operating expenses in mining. The recent 20-25% crash in crude oil prices has slashed input costs:

- Diesel fuel, electricity, and transportation all fall in tandem with crude

- Lower energy costs flow directly into reduced all-in sustaining costs (AISC)

For gold and silver miners producing at marginal profitability, this margin expansion should transform break-even operations into high-margin cash generators, even without a further rise in silver prices. With silver at $32.50 and costs dropping, silver miners are entering a golden window of profitability.

III. Industrial Demand for Silver Is Soaring

Silver is not only a precious metal, but a key industrial input. Its physical properties make it indispensable in fast-growing technologies:

- Solar panels (highest electrical conductivity of any element)

- Electric vehicles (battery contacts, power systems)

- 5G, semiconductors, and medical instruments

At the same time, the supply side remains constrained:

- Global silver production peaked in recent years and is now in slight decline

- Mine depletion is accelerating

- There has been minimal investment in new silver exploration or development since the last commodity cycle

This demand/supply imbalance is now entering a compounding phase where expanding needs confront stagnant output, pushing prices higher.

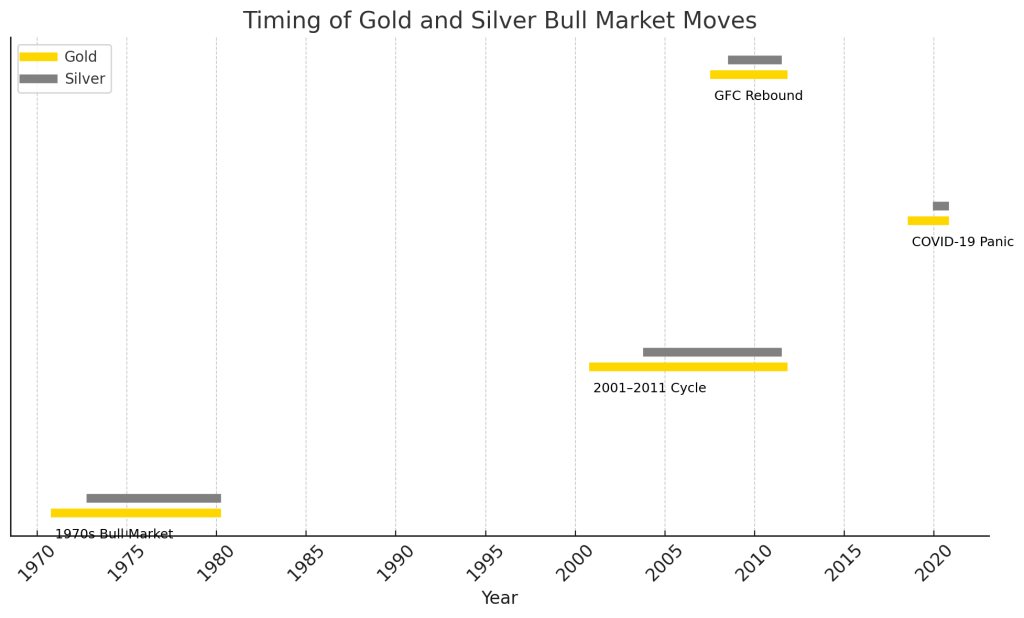

IV. Historical Pattern: Gold Leads, Silver Surges

One of the most consistent and compelling dynamics in precious metals markets is the sequence of gold moving first, followed by a more explosive surge in silver. This phenomenon is not theoretical; it is grounded in decades of historical precedent. In virtually every major bull cycle for precious metals, silver lags gold’s breakout, then catches up rapidly with amplified percentage returns.

The chart below highlights several historical case studies:

| Period | Gold Gain (%) | Silver Gain (%) | Notes |

| 1970s Bull Market | ~2,200% | ~3,200% | Gold led early; silver exploded late in the cycle |

| 2001–2011 Cycle | ~600% | ~1,070% | Silver lagged until 2008–2009, then surged |

| COVID-19 Panic (2020) | ~72% | ~140% | Silver stayed flat until March 2020, then doubled |

| Great Financial Crisis | ~0% (flat) | ~100% rebound | Gold held firm; silver crashed, then rebounded harder |

| 1987 Crash Recovery | ~10% | ~20% | Modest moves, but silver outperformed on the rebound |

This lagging-yet-leveraged behavior is driven by silver’s dual role as both a monetary and industrial metal. Gold tends to move first as a safe-haven hedge in crises. Then, once inflationary pressure builds or reflationary stimulus begins, silver accelerates rapidly due to its tighter physical market and broader demand base.

In the context of 2025, with gold already at all-time highs and the gold/silver ratio still elevated near 100:1, the stage is set for silver to repeat this historical pattern. And because silver miners offer 2–5X+ leverage to silver’s spot move, the silver equities sector stands to benefit even more dramatically as the cycle unfolds.

V. Silver Miners Offer Maximum Leverage to Silver’s Repricing

As stated above, silver miners have offered 2x–5x+ the upside of physical silver. This is due to:

- Operational leverage: Revenues rise faster than costs during bull runs

- Valuation compression: Many quality miners trade at low single-digit forward P/E ratios

- Market neglect: Institutional ownership of silver miners remains extremely low

Well-capitalized producers and developers in stable jurisdictions will be the first to benefit from a silver price surge, but even junior exploration companies may offer outsized gains if capital rotates aggressively into the sector.

VI. Valuation Compression: Silver Miners Trading at Historically Low P/E Ratios

Despite the favorable macroeconomic backdrop, many silver mining companies are currently trading at historically low price-to-earnings (P/E) ratios, indicating extreme undervaluation:

- Silvercorp Metals Inc. (NYSE:SVM): P/E ratio of 6.80 as of April 14, 2025, demonstrating the stock is trading at less than seven times its earnings.

- Fortuna Silver Mines Inc. (NYSE:FSM): P/E ratio of 5.91, indicating strong earnings relative to its share price.

- New Gold Inc. (NYSE:NGD): P/E ratio of 7.89, screaming undervaluation in the market.

These low valuations strongly imply that the market has yet to fully price in the improved profitability and growth potential of these companies, especially in light of rising silver prices and declining operational costs.

Conclusion: A Rare, Asymmetric Setup for Massive Upside

Today’s 99.75:1 silver/gold ratio may not be an all-time record, but it sits at levels only seen during the most extreme dislocations in modern history. With oil collapsing, input costs falling, and demand surging from both monetary and industrial use cases, the silver mining sector stands uniquely positioned for explosive upside. There is a “perfect storm,” so to speak, for a valuation play.

This moment echoes the early stages of other great commodity supercycles: a cheap and “hated” asset class, underowned by institutions, with improving fundamentals and extreme mean-reversion potential. Silver itself may rise 50–100% from current levels, but silver miners could deliver many, many multiples of that.

Silver miners are not just undervalued, they are primed.

The smart capital is already moving. The rest of the market will follow. Investors who understand the magnitude of this setup have a rare opportunity… before the reversion wave begins.

NB: The foundation of my investment thesis rests on one of the most enduring and reliable principles in financial markets: mean reversion. Prices may diverge wildly from intrinsic value in the short term, but over time, they almost always revert to their historical averages, whether in valuations, commodity ratios, or earnings multiples. This is the core belief behind deep value investing, popularized by thinkers like Benjamin Graham and carried into the quantitative era by Tobias Carlisle, author of Deep Value and developer of the Acquirer’s Multiple. Carlisle’s research demonstrates that the most undervalued stocks (those trading at the lowest enterprise values relative to their operating earnings) consistently outperform over time, not because the market suddenly becomes rational, but because mispricings eventually correct. The silver mining sector, as it stands today, is an archetypal deep value setup: hated, overlooked, underpriced, and yet sitting on the precipice of explosive mean reversion. The asymmetry is clear, and history favors those who step in before the rubber band snaps back. 🙂

Postscript. This is Pure Speculation!

I normally wouldn’t feel the need to qualify my analysis above with such trite observations as this, but I suppose in this day and age one should be direct and unambiguous. To the extent that one takes this thesis at face value and chooses to invest in the silver mining sector, please recognize it is a TIER 4 asset class.

In other words, this is speculation—pure and simple (just as 99% of stock market investing is). One should always be mindful of the “Pyramid of Wealth” when investing their capital (as clearly defined in my book, “The Investor’s Warp Whistles” – Chapter 2). Tier 4 assets should never make up more than 15% (max) of one’s total net worth. Read my book for more info!