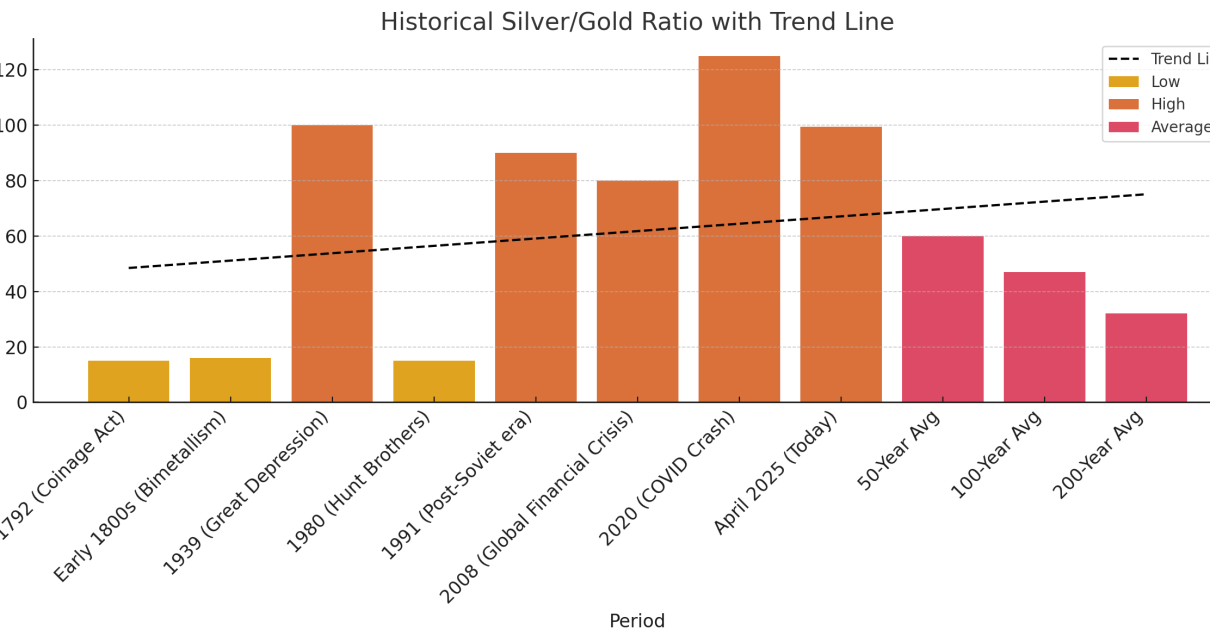

By Sean Dempsey, 04/15/25 The silver mining sector stands at the threshold of a potentially historic rally, driven by a rare confluence of macroeconomic imbalances, collapsing input costs, and structural mispricing. As of April 2025, the silver-to-gold ratio sits just under 100:1, a level that, while not unprecedented, remains among the most extreme in modern […]

Leveling the Playing Field

A whimsical children’s tale to help explain the wonders and audacious logic of tariffs. == Tank Thompson, wild-eyed and grinning, cut off his own ear at recess. Nobody knew why. Maybe it was a dare no one heard … or just a storm inside him finally breaking loose. Blood slicked his neck. He held the […]

Tariffs are a Trojan Horse

by Sean Dempsey, 04/03/2015 Tariffs Explained Tariffs, often sold as shields to protect a nation’s workers and industries, are in reality a cruel tax that falls hardest on the poor and middle class of the very country that levies them. Far from safeguarding prosperity, they distort markets, inflate prices, and erode purchasing power, as some […]

2025: The Year the Wokeism Wave Crested?

By Sean Dempsey, 04/03/25 In hindsight, 2024 will likely be chronicled in history books as the year when the postmodern fever broke—an era marked by an unchecked commitment to relativism, the absurd elevation of subjectivity, and an almost religious rejection of objective truth. Beauty was no longer allowed to exist on its own terms; instead, […]

THE LOST TAPES OF DR. MICHEL SIFFRE

What you are about to read is based on a TRUE story. Michel Siffre is 100% REAL and actually did this! =============== by Sean Dempsey, 04/02/25 A Chronicle of Isolation, Madness, and Savage Darkness In the early 1970s, as Cold War psychology and space exploration collided with radical ideas about human consciousness, a lesser-known but […]

The Shelter-Door Was Strong and Thick

By Sean Dempsey, 03/31/25 The sun sank low on Lilac Lane;The stars began to peep.And laughter rang from mouths of men Who’d never yet known grief. With meat and wine their hearts were glad—Their tables richly spread.Till sudden came the radio’s cry: “A bomb shall strike,” it said! Then silence fell like Yahweh’s tomb, […]

A Fool’s Gold

Sean Dempsey, 04/01/2025 There was once a king so rich that other kings wept when they heard his name. His majesty, Kaiser My’Kael Sellur, High King of the Lost Isles of Bit’Quon, ruled over a land where wealth dripped from every rooftop and pooled in the gutters. His vaults ran so deep and wide that […]

The Obsolete Mr. Malum

By Sean Dempsey, 03/28/2025 This echo-filled chamber of judgment was not built to house men, but to erase them. Its walls were clean, without seams, without windows, without warmth. Light spilled from hidden fixtures like surgical lamps—cold, clinical, sterilizing. Every sound echoed twice. Each breath of the men and women in this dim legal sanctuary […]

The Innocents Among Us: An Analysis of the Human Spirit from Dostoevsky’s “The Idiot” to “Ted Lasso”

By Sean Dempsey, 03/23/25 “The main idea of the novel is to depict the positively good man. There is nothing more difficult than this in the world, especially nowadays… the task is immeasurable…” – Fyodor Dostoevsky In the intricate interplay of characters and their societal backdrops, the portrayal of characters imbued with an almost divine […]

The Myth of Constitutional America: How a Nation Betrayed Its Own Founding Document

To Those Just Now Waking Up—Where Have You Been? By Sean Dempsey, 3/20/25 Oh, so now you see it? Now, after decades of rampant government abuse, after endless wars, after a surveillance state that tracks your every move, after a Federal Reserve that devalues your savings into dust—now you’re realizing that the U.S. government doesn’t follow the Constitution? […]